- Swingly

- Posts

- Markets His Highs — Here’s What You’re Missing

Markets His Highs — Here’s What You’re Missing

OVERVIEW

Capital Rotation Meets Breakout Tension

🟢 Risk-On: SPY closed at all-time highs, QQQ sits just beneath its own, and IWM broke through key control levels. Breadth (NH/NL, VSI) continues to expand, while volatility (VIX) compresses — clear signs that this market remains structurally bullish.

📊 Broad Market Structure:

We’re in a compression-expansion phase. Earnings are driving episodic surges in capital flows (e.g., $GOOG), while smaller names digest prior strength. Liquidity is rotating, not retreating — and breakouts are emerging with stronger foundation.

🧠 This Is Where Patience Converts to Edge

This environment tests discipline: leadership is shifting, setups are tighter, and timing matters. Pullbacks are still being bought. Reclaims are sticking. If you’re tracking the right themes with clean technical structures, you don’t need many trades — you just need the right ones.

MARKET ANALYSIS

Google Beats, Tesla Misses.

Markets are mixed this morning as traders digest a wave of earnings and renewed macro headlines.

Google ($GOOG) is lifting Nasdaq futures with a strong earnings beat and bullish AI momentum.

Tesla ($TSLA) is weighing on the broader indices after missing expectations and warning of pressure ahead without EV tax credits.

Chipotle ($CMG) and IBM ($IBM) also dragged sentiment lower following weak sales updates.

On the macro side, trade headlines and central bank tensions are back in focus. Reports show the U.S. is moving closer to a new trade deal with the EU — one that could raise tariffs to 15% but would remove some near-term uncertainty. This helped stocks push higher on Wednesday.

At the same time, former President Trump is now escalating pressure on the Federal Reserve, with a planned visit to the central bank today — the first time a president has done so in nearly two decades. While largely symbolic, it adds another layer of political tension at a time when rates and policy expectations are stabilizing.

Bottom line: markets are holding up well as long as leadership names deliver, but volatility is likely to stay elevated around big tech earnings and macro events. Watch for capital rotation and stock-level dispersion to continue- stop out risk is elevated.

Nasdaq

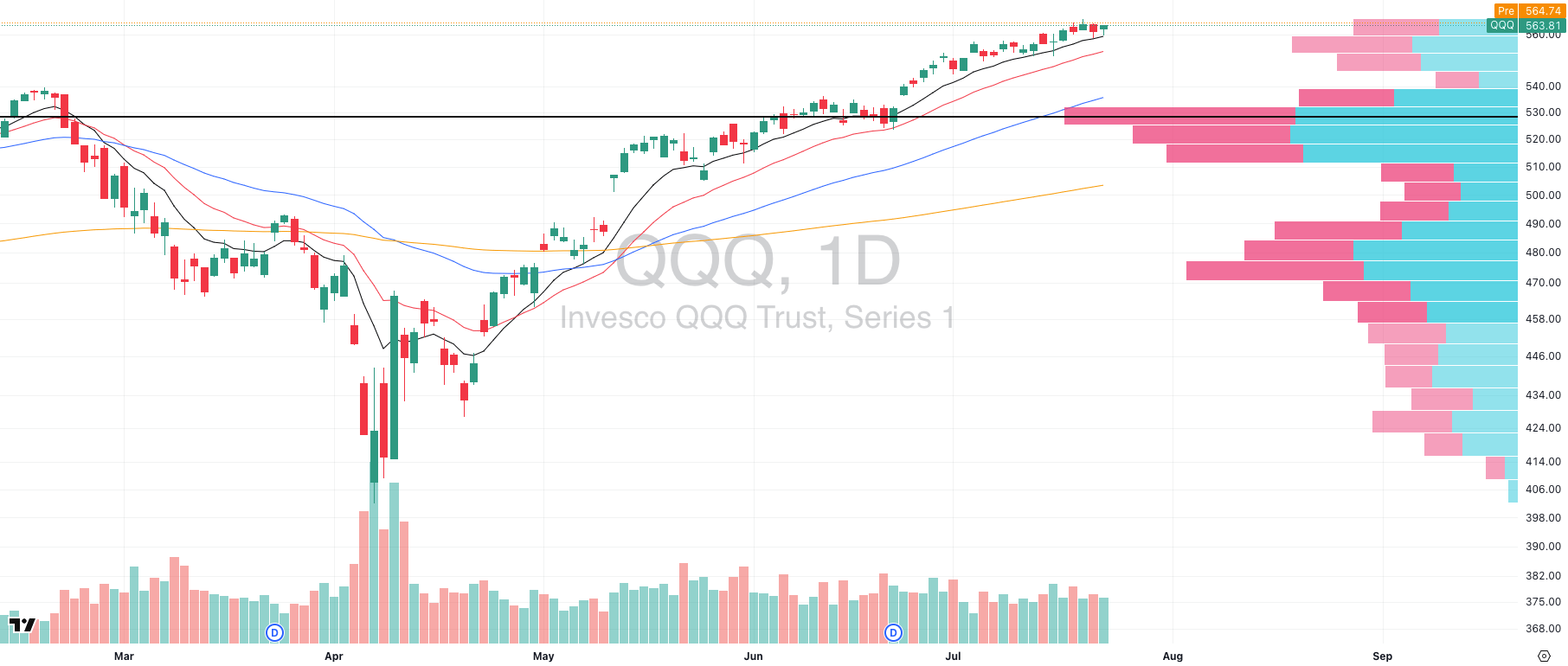

QQQ VRVP Daily Chart

The QQQ had a strong session yesterday, reclaiming ground that had looked vulnerable just days prior. Last week, we saw key leaders in the group with names like $NVDA, $MU, and $PLTR breaking below their daily 10EMAs, raising some concern about short-term trend pressure. But that weakness was short-lived.

Yesterday’s rebound in those same names- especially with strong closes across the board- was exactly the confirmation we needed to stay risk-on.

Technically, QQQ has been in a tight contraction range for the past 1–2 weeks, coiling just below all-time highs. While large-cap tech has remained choppy due to earnings volatility, growth and small-cap tech have continued to outperform, suggesting internal rotation rather than broad weakness.

Now, with SPY already breaking into new highs, the expectation is that QQQ will follow, potentially as early as today. A clean breakout would resolve the recent range and confirm strength across the cap spectrum.

S&P 400 Midcap

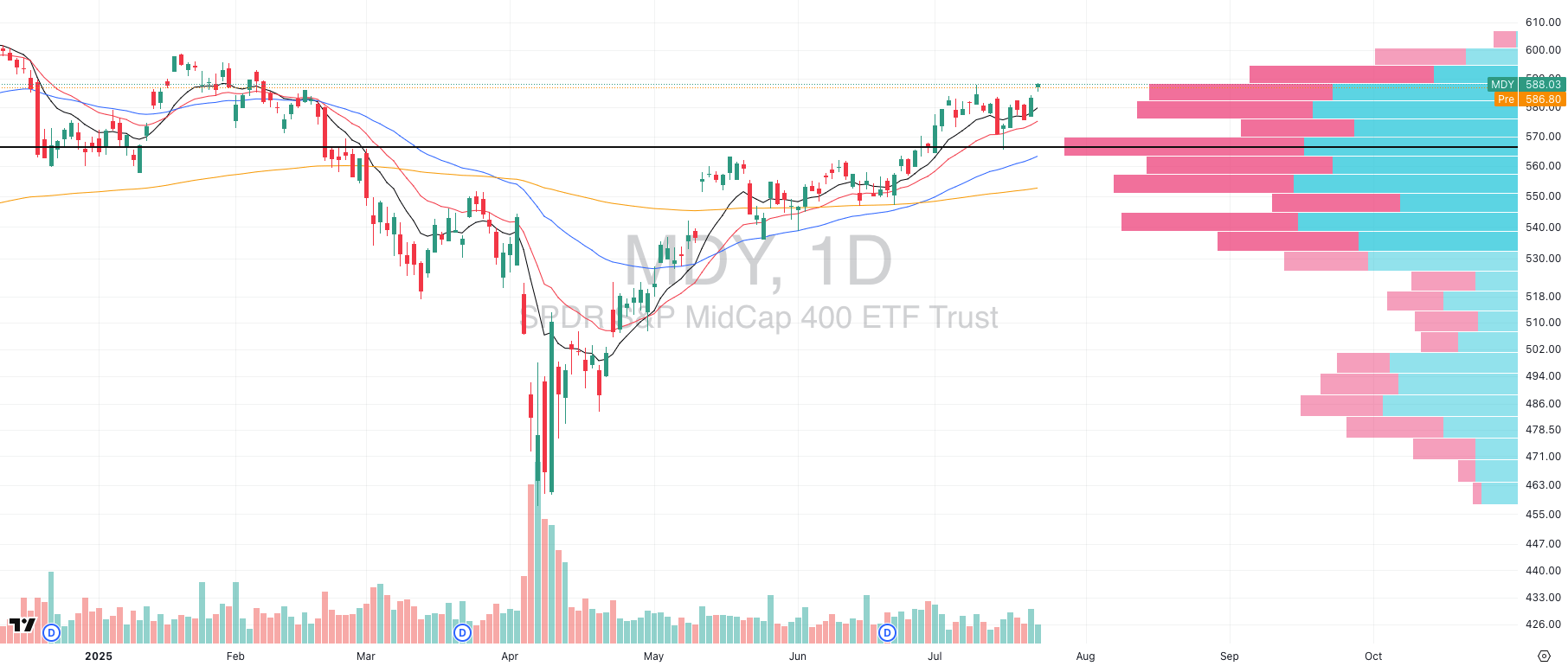

MDY VRVP Daily Chart

Midcaps ($MDY) gapped higher yesterday, pushing through a dense volume shelf on the VRVP — a level that has so far acted as support. But while the move looked strong on the surface, relative volume was notably low, which raises questions about the strength of the breakout.

For a move like this — especially a gap-up open through prior supply — we typically want to see elevated volume to confirm conviction. Without that, the odds of a full follow-through decline. A gap fill or retest lower from here is not only possible, but fairly typical in this kind of setup.

That said, this isn’t a bearish signal. Many midcaps are still showing strong individual setups, and breadth beneath the surface remains healthy.

The key issue is liquidity: with mega-cap earnings in full swing, big names like $GOOG could draw capital away from midcap names in the short term. Until volume steps in, we’re cautious on adding new exposure here.

Russell 2000

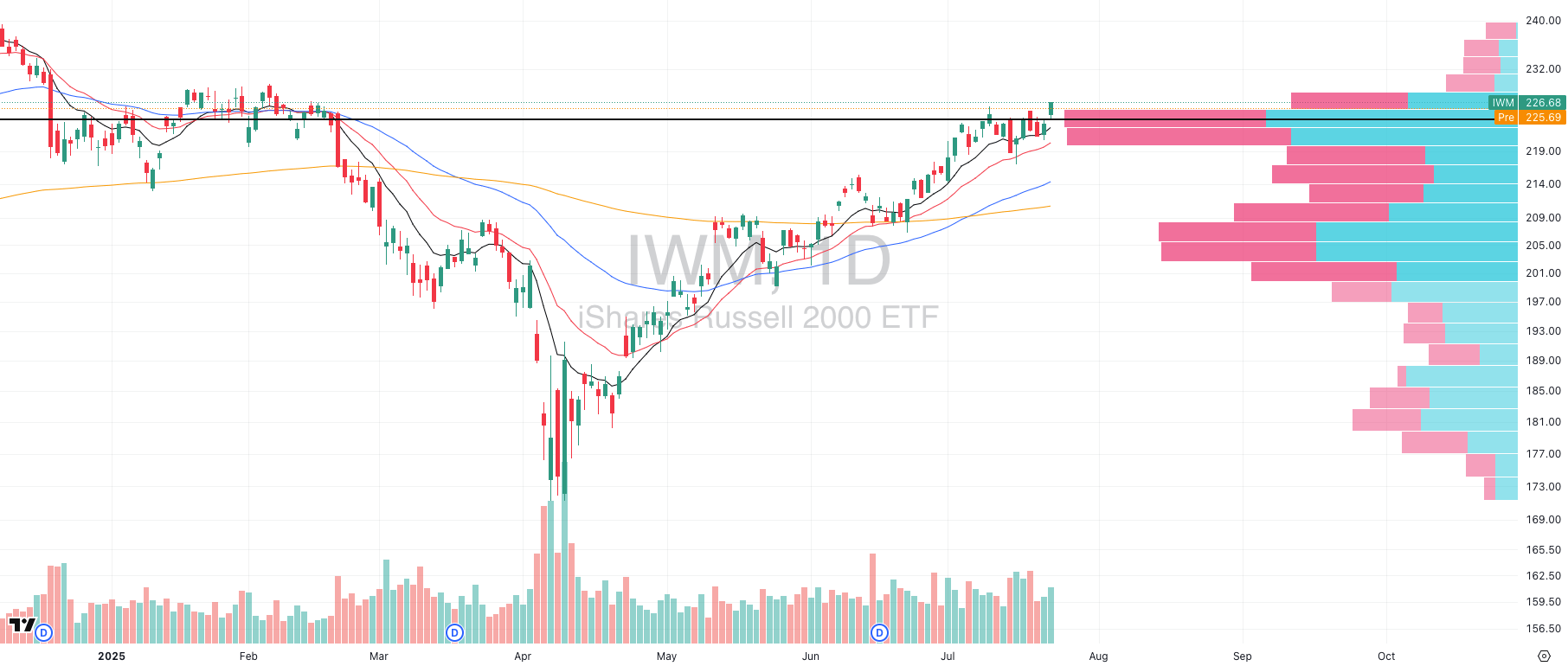

IWM VRVP Daily Chart

Small caps continue to lead, and IWM remains our highest-conviction index in terms of relative strength and upside potential.

Yesterday, IWM cleared its Point of Control (POC) with conviction, pushing into a price zone we haven’t seen since February 2025 — just before the broad market’s last major correction. The breakout came on strong relative volume, unlike midcaps, signaling that this move has real backing from institutional flow.

Unlike SPY and QQQ, which are dominated by mega-cap tech, IWM carries a much higher short interest — which adds fuel to upside moves and helps explain the velocity we’re seeing.

We continue to see small-cap setups across leading sectors (tech, clean energy, etc.) offering some of the best swing opportunities. When you can align a small-cap chart with a strong sector-level theme, it creates multi-layered momentum — the kind of alignment that often leads to outsized moves.

That said, it’s important to recognize the liquidity risk in the short term. With earnings in mega-cap tech ramping up, there’s always a chance capital rotates out of small caps and into the big names that move the indices. We’ve seen this play out many times before.

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

FOCUSED STOCK

GOOG: AI Trade Alive & Well

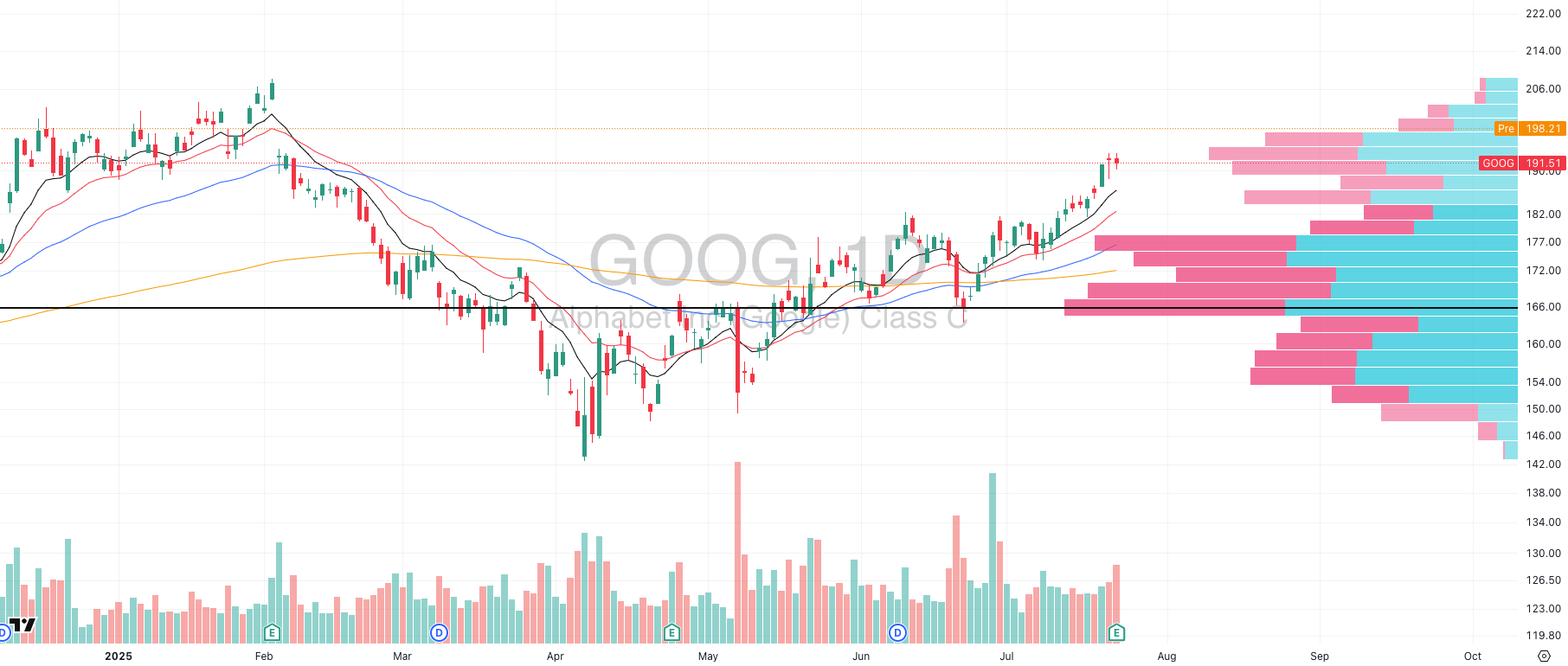

GOOG VRVP Daily Chart

One name we’ve been stalking closely into earnings is $GOOG, and this morning it’s delivering exactly the kind of setup that sits at the core of episodic pivot trading.

Following its earnings report, $GOOG is gapping up through a dense volume shelf at $197.45 (as seen on the VRVP), clearing out overhead supply established back in late 2024-early 2025, and triggering a potential expansion move toward all-time highs.

This is a textbook Qullamaggie-style EP trade: a high-conviction fundamental catalyst (earnings), clean technical trigger (gap through volume on a large base), and powerful market narrative (AI leadership).

Why this matters:

$GOOG isn’t just another stock, it’s a top-5 market cap heavyweight, and its movement shapes the entire tech index

It’s also a key AI exposure name, meaning it pulls in both institutional and thematic flows

Historically, large-cap tech names that gap and go on earnings tend to follow a PEAD pattern (Post-Earnings Announcement Drift) — with bullish drift over the next 10–30 days

Whether you’re already in or waiting for a pullback entry, the priority now is tracking how $GOOG handles the open- does it hold the gap, accelerate through highs, or fade?

If we see a rejection and big fade lower on $GOOG, keep in mind this can in turn drive the entire market down too and push sentiment lower.

FOCUSED GROUP

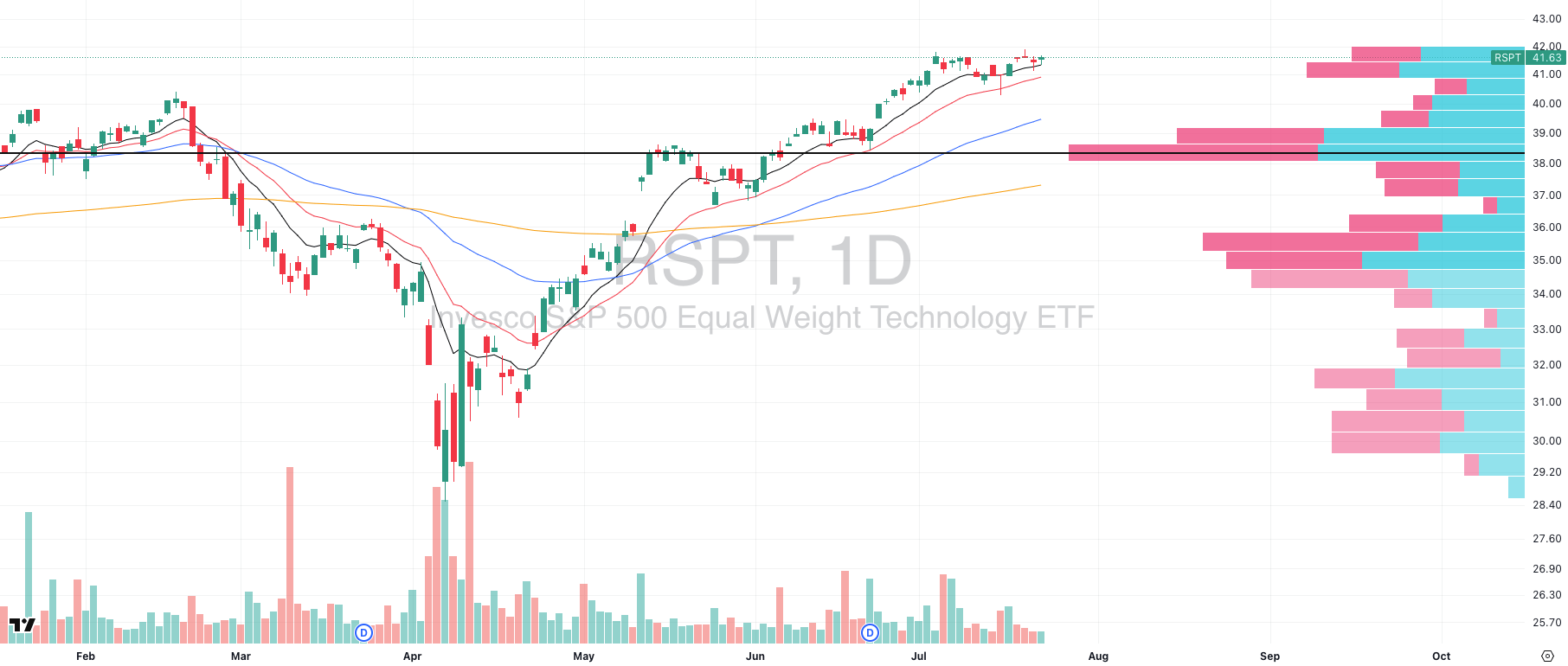

RSPT: Technology Looks Explosive

RSPT VRVP Daily Chart

Over the past week, tech has looked heavy on the surface, but what’s really happened is orderly rotation, not breakdown. Semiconductors led the fade, with sharp pullbacks in $MU and $NVDA dragging sentiment, but yesterday’s session flipped the tone: $QQQ pushed higher, and key leaders like $NVDA and $PLTR were aggressively reclaimed into the close.

The real tell is in equal-weight tech:

$RSPT has entered a low-volume contraction phase, building a tight base just beneath all-time highs (~$42)

There’s no distribution, no pani, just compression

These setups often precede explosive directional moves

This is important context: the strength isn’t just coming from a handful of mega-caps- breadth within the tech sector is stabilizing, and equal-weight leadership here is a strong signal of sector-wide accumulation, not just passive indexing flows.

In other words: tech isn’t falling apart- it’s setting up.

With earnings flow ramping and volatility compressing, this could be the calm before a sector-wide expansion. Eyes on $RSPT for resolution.

Did you find value in today's publication?This helps us better design our content for our readers |

Reply