- Swingly

- Posts

- Market’s Next Move Hinges on This Week’s Earnings

Market’s Next Move Hinges on This Week’s Earnings

OVERVIEW

What You Need To Know

Macro: Markets remain rangebound ahead of Tesla and IBM earnings, with conviction low and sentiment cautious. Best approach remains to stay defensive, raise cash, and wait for a confirmed trend.

Nasdaq (QQQ): The index leads but continues to climb on weak volume, forming a possible double top between October 8–10 and 20–22. A clear hourly volume divergence since October 17 hints at buyer exhaustion despite strong optics.

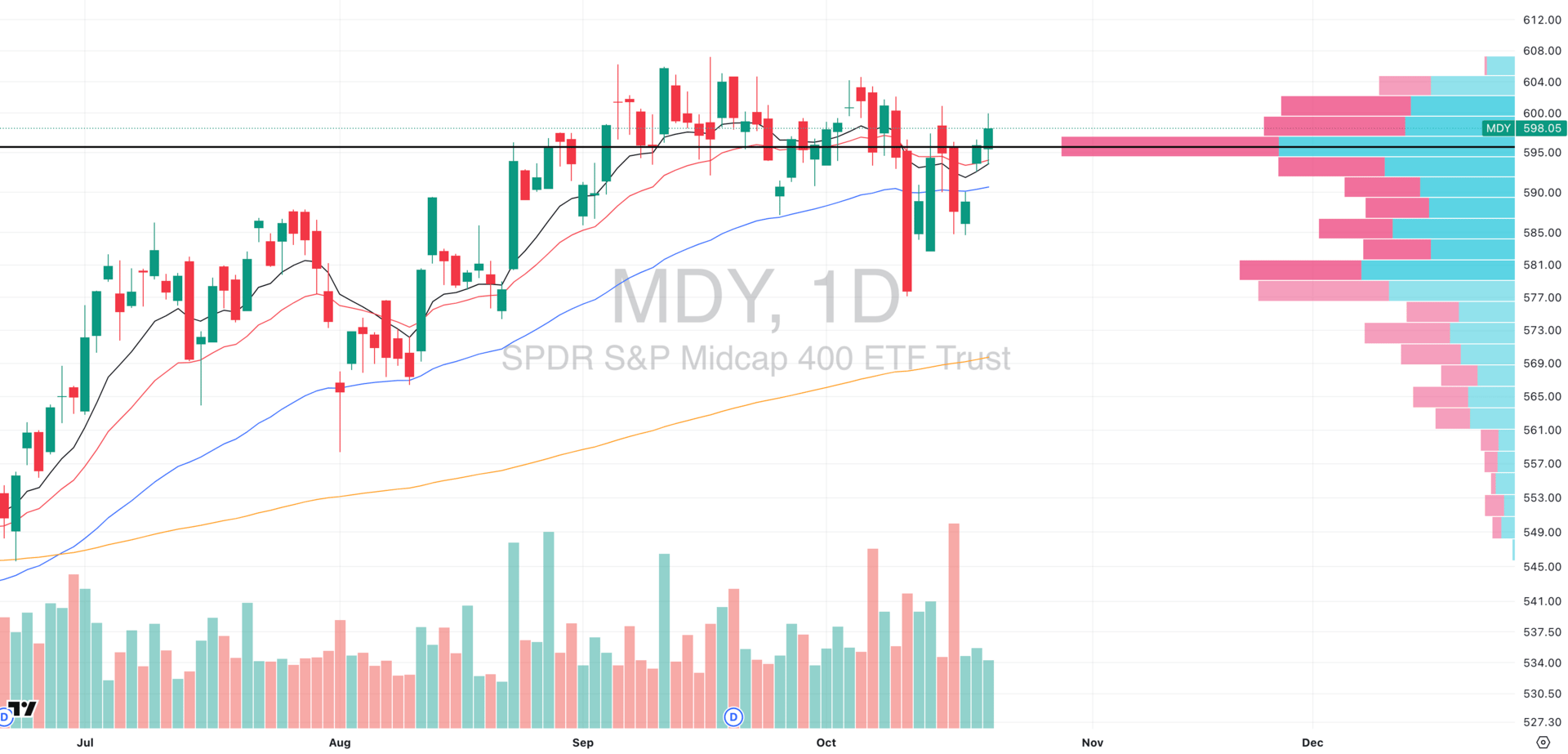

Midcaps (MDY): Still consolidating inside a tight range under $604 with just 71% relative volume yesterday. No clear direction as intraday pushes remain choppy and can easily eat away at capital if traded reactively.

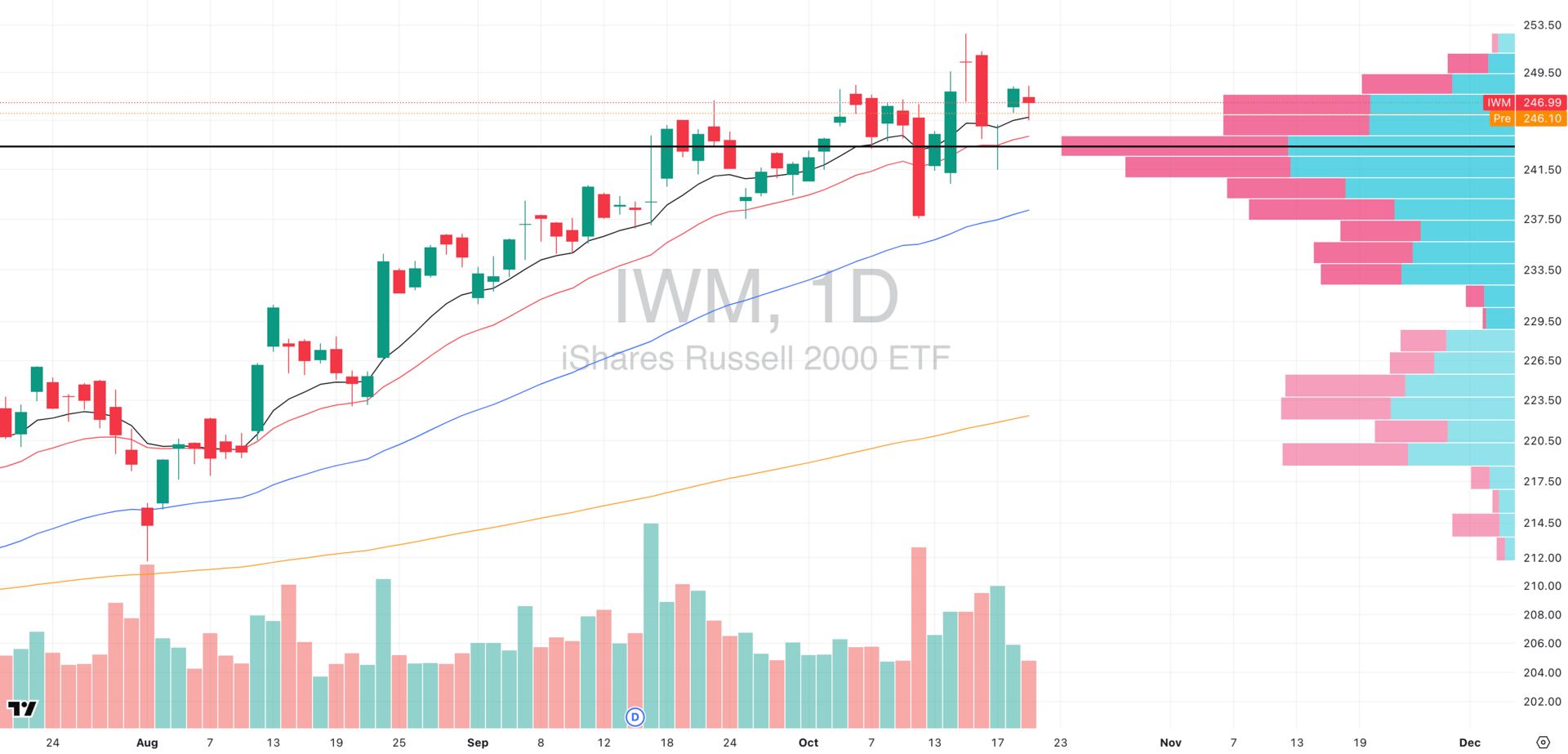

Small Caps (IWM): Another low-volume day at 70% of average but printed a constructive doji bounce off the 10-day EMA. Weekly trend still intact, so we’re avoiding shorts until earnings clarify direction.

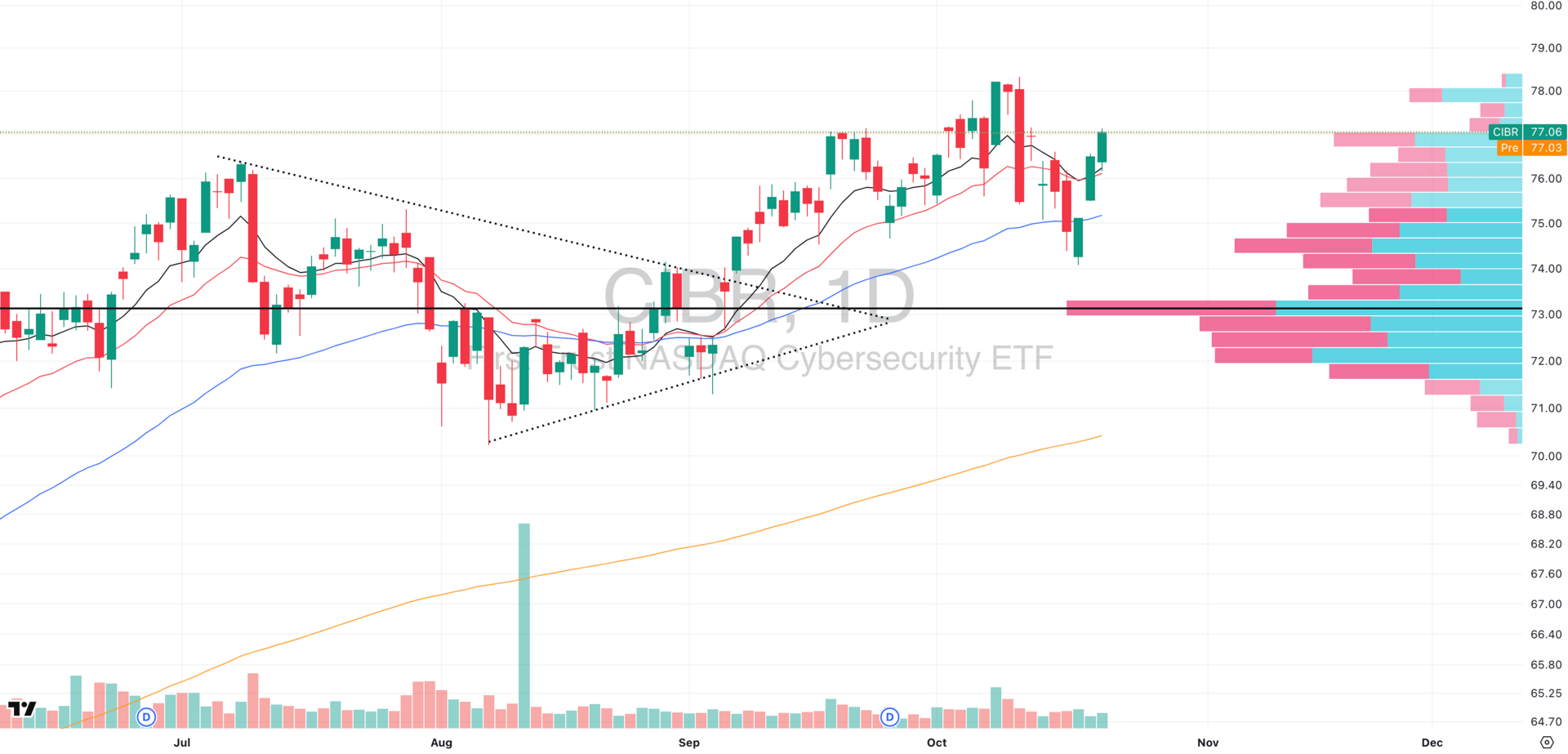

Focused Stock – PLTR: Holding a tight consolidation since August, maintaining strong relative strength within cybersecurity. CIBR’s group rebound reinforces the setup, but we’re waiting for a confirmed breakout with higher volume before re-engaging.

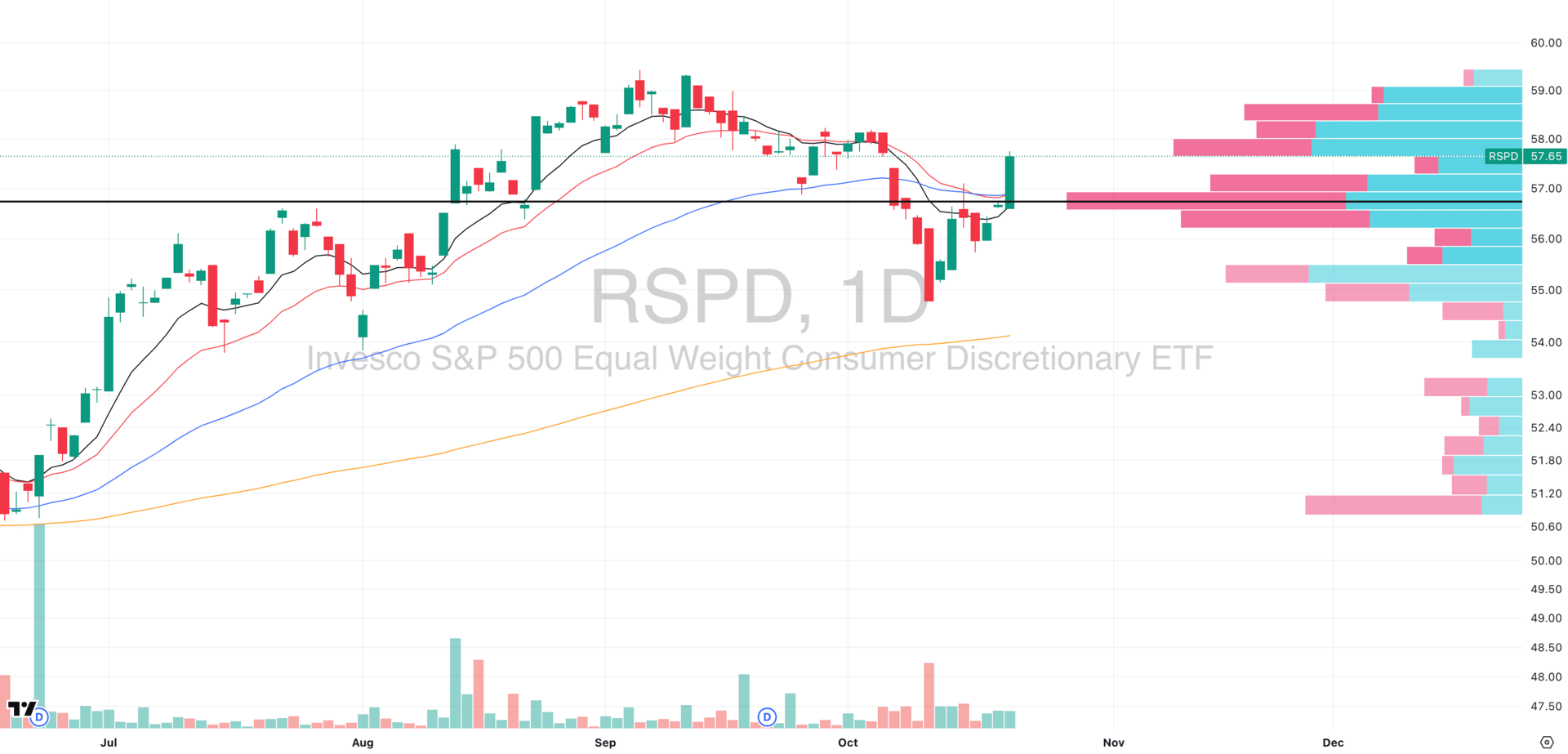

Focused Group – Cyclicals (XLY & RSPD): Both ETFs rallied together, signaling genuine sector-wide strength rather than isolated leadership. This synchronized move is constructive and rare ahead of breakdowns, but we need follow-through beyond XLY’s $239–$242 resistance before getting conviction.

MARKET ANALYSIS

A Very Choppy Climate: Seek Defense

Markets are again holding steady this morning as traders brace for a wave of earnings reports from major companies including Tesla (TSLA) and IBM (IBM). After a volatile stretch last week, sentiment remains cautious, with investors weighing mixed signals from corporate results and policy headlines.

Earnings season continues to take center stage. While strong results from several blue-chip firms earlier in the week offered some relief, disappointments like Netflix (NFLX), which fell after missing earnings expectations due to a Brazil tax dispute, are keeping optimism in check.

Gold is stabilizing after its sharpest one-day drop in more than a decade, as traders reassess safe-haven demand amid shifting geopolitical headlines. Reports of the U.S. and India nearing a tariff-cut deal are also helping ease broader trade tensions.

With official economic data still limited due to the government shutdown, attention now turns to Friday’s CPI report, a key indicator that could shape expectations ahead of the Federal Reserve’s meeting next week, where another rate cut remains widely anticipated.

Note: this is still a very volatile and rather unpredictable market. Shorts have gained significantly greater traction that long plays, however even still, the best play in our opinion is raising cash and waiting for a clear trend to develop.

Nasdaq

QQQ VRVP Daily Chart

QQQ VRVP Hourly Chart

% over 20 EMA: 75.24% | % over 50 EMA: 64.35% | % over 200 EMA: 61.38%

The QQQ continues to lead, but yesterday’s advance once again came on low relative volume, reinforcing the lack of conviction behind this push.

The pattern forming between October 8–10 and October 20–22 resembles a potential double top, with price now consolidating tightly along the rising 10-hour EMA.

On the hourly timeframe, a clear volume divergence has emerged since October 17 as price has been grinding higher while volume continues to contract, a setup that typically resolves to the downside when buyers exhaust.

We have to mention we are entering big tech earnings season and so if there is going to be a quick recovery, this is by far the group which will have the highest probability of an upside push - don’t get too bearish on the Nasdaq.

S&P 400 Midcap

MDY VRVP Daily Chart

% over 20 EMA: 54.61% | % over 50 EMA: 46.38% | % over 200 EMA: 59.10%

MDY continues to chop sideways inside its range, with no conviction from either side. Yesterday’s session printed just 71% of its 20-day average volume - even lighter than Monday or Tuesday - confirming lack of engagement.

The ETF remains capped under $604, and until we see a decisive, high-volume breakout through that zone, this is a complete avoid.

This is a very difficult environment for traders as these intraday pushes are sharp but non-directional, and reacting too aggressively to them can slowly erode your account. We find much greater clarity comes from creating watchlists which specifically track the performance of stocks inside the group (in this case MDY) to determine stock health- it is still weak.

As mentioned before, if strength is to appear anywhere this earnings season, it will likely come from Nasdaq leadership, not from midcaps.

Russell 2000

IWM VRVP Daily Chart

% over 20 EMA: 50.96% | % over 50 EMA: 47.90% | % over 200 EMA: 58.46%

IWM printed yet another low-volume session yesterday at just 70% of its 20-day average volume, matching the weak participation we’ve seen across MDY and QQQ.

We do like the doji candle forming here as it shows intraday rejection and a clear bounce off the rising 10-day EMA, a sign that short-term buyers are still defending key trend support.

Despite the lack of strong follow-through, the intermediate trend on the weekly timeframe remains intact, so we’re not shifting fully bearish yet as this is precisely why we’ve avoided short setups recently.

The key now is how small caps react through earnings season; they’re sitting right on a critical balance point where a decisive move either confirms trend resumption or signals a breakdown of relative strength.

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

FOCUSED STOCK

PLTR: Cybersecurity Bounces Hard

PLTR VRVP Daily Chart

CIBR VRVP Daily Chart

ADR%: 4.19% | Off 52-week high: -4.5% | Above 52-week low: +343.8%

PLTR continues to hold up impressively within a tight multi-week consolidation that began on August 4th, sitting firmly above its 20- and 50-day EMAs.

The stock remains one of the strongest leaders not only within its group (CIBR – Cybersecurity ETF), but also across the broader market.

CIBR itself has bounced sharply off its base, confirming institutional demand returning to the cybersecurity group and thus a major tailwind for PLTR.

We continue to monitor PLTR closely as it often leads the market before the broader indices turn higher; it serves as both a leadership gauge and a potential early recovery proxy.

This remains one of the few names on our long watchlist, but we’re waiting for confirmation via a decisive breakout above the upper range on expanding volume before considering exposure.

The red hammer candle too shows demand has stepped in on the 10 and 20 EMA daily tests- though this was on incredibly low volume (only 44% 20 day average).

FOCUSED GROUP

XLY: Cyclicals Attempt A Recovery

XLY VRVP Daily Chart

RSPD VRVP Daily Chart

We didn’t expect consumer discretionary to bounce this strongly as both XLY (cap-weighted) and RSPD (equal-weighted) have advanced together, showing broad participation rather than leadership confined to a few mega caps.

RSPD has cleanly broken above its Point of Control (POC), while XLY is now pushing into a dense overhead supply zone around $239–$242 which was a key test area where prior distribution occurred.

You typically don’t see this kind of synchronized strength if the market were about to break down, especially not in cyclicals or growth-linked sectors. This makes the move a constructive sign for the bulls.

That said, we need to see a clear trend structure develop before assigning conviction as earnings can easily distort short-term behavior, which is why we continue to emphasize caution and patience in this environment.

Did you find value in today's publication?This helps us better design our content for our readers |

Reply