- Swingly

- Posts

- Market Flashing Warning Signals 🚨

Market Flashing Warning Signals 🚨

This Smart Home Company Hit $10 Million in Revenue—and It’s Just the Beginning

No, it’s not Ring or Nest—it’s RYSE, the company redefining smart home innovation, and you can invest for just $1.75 per share.

RYSE’s patented SmartShades are transforming how people control their window shades—offering seamless automation without costly replacements. With 10 fully granted patents and a pivotal Amazon court judgment safeguarding their technology, RYSE has established itself as a market leader in an industry projected to grow 23% annually.

This year, RYSE surpassed $10 million in total revenue, expanded to 127 Best Buy locations, and experienced explosive 200% month-over-month growth. With partnerships in progress with major retailers like Lowe’s and Home Depot, they’re set for even bigger milestones, including international expansion and new product launches.

This is your last chance to invest at the current share price before their next stage of growth drives even greater demand.

Exposure Status: Risk Off

OVERVIEW

Today’s Inflation Data May Spike Volatility

The stock market has been pretty quiet this past week, with most big investors sitting on the sidelines. It looks like they’re waiting to see if this slowdown is just the usual seasonal dip we often see in mid-December. Historically, participation tends to pick up again as we head toward the end of the year, which could bring the classic "Santa Claus rally."

Right now, stocks aren’t far from record highs, but investors are focused on a key update coming this Wednesday: the November inflation report. This data could set the tone for what’s next, especially since it will play a big role in shaping the Federal Reserve’s next interest rate decision.

Why Today’s CPI Report Matters

The Consumer Price Index (CPI) report, out at 8:30 a.m. ET, is critical. It’s one of the last big pieces of data before the Fed decides whether to cut rates again this year. So far in 2024, rates have already been lowered by 0.75%, but this inflation update could tip the scales for the next move.

Economists expect headline inflation to tick up slightly to 2.7% year-over-year, compared to 2.6% in October. Month-over-month, prices are forecast to rise by 0.3%, a bit faster than October’s 0.2% increase. Stripping out food and energy costs (the “core” CPI), inflation is expected to hold steady at 3.3% year-over-year, with monthly gains also at 0.3%.

This report is a big deal. If inflation remains under control, it could open the door for the Federal Reserve to cut rates in December, which would likely give the market a boost. However, it’s a tricky balance. The market needs inflation to stay low enough to convince the Fed that it’s safe to ease policy, but at the same time, it benefits from signs of a slightly weaker job market. Why? Because a softer labor market would signal that it’s time to shift focus from restricting growth to actively supporting the economy and promoting recovery. It’s a delicate dance between stability and growth, and this CPI report is a key step in that process.

Nasdaq

QQQ VRVP Daily Chart

The Nasdaq continued to face challenges in yesterday’s session, breaking below its $523 demand level, which had served as support since Wednesday, December 4th. This drop pushed the QQQ closer to its daily 10-EMA, where we saw some buying interest emerge.

However, much of the strength in the QQQ remains concentrated in a handful of mega-cap stocks—Meta, Google, Apple, and Tesla—propping up the broader index. Meanwhile, the majority of tech names are struggling, as reflected by the QQQE, the equal-weighted version of the QQQ, which shows a much broader breakdown across the sector. This divergence highlights the narrow leadership currently driving large-cap tech to remain afloat.

QQQE VRVP Daily Chart

Taking a closer look at the QQQE, yesterday's session highlighted a significant breakdown as it lost its daily 10-EMA on high volume. While some support emerged around the 20-EMA and the dense Point of Control (POC)—areas where buyers typically step in and sellers often lock in profits—the overall weakness suggests a cautious sentiment. These levels may act as temporary support, but sustained buying will be key to reversing the broader downtrend seen in the equal-weighted index.

We might see a short-term bounce or some consolidation around these support levels on the QQQE, but the overall trend remains clearly bearish. Without broader participation or a shift in market sentiment, any recovery here is likely to be temporary.

S&P Midcap 400

MDY VRVP Daily Chart

Midcaps continue to underperform, with two consecutive high-volume breakdown days—first losing their 10-EMA and, yesterday, breaking below the critical daily 20-EMA. The 20-EMA is a key support level, and its failure to hold is concerning. According to the Visible Range Volume Profile (VRVP), the MDY has already fallen below its Point of Control (POC), a bearish signal that now leaves the $600 level as the next major support.

This $600 level is significant for two reasons: it’s a high-volume area and a key psychological marker that often acts as a magnet. If the MDY breaks below $600, it could spark increased fear in the market, potentially triggering a sharper markdown phase—a typical reaction to the loss of such critical support levels (consider what happened with Bitcoin on the $100,000 break last week).

Russell 2000

IWM VRVP Daily Chart

Small caps are facing a similar situation to midcaps, as they often move in tandem. However, their position is slightly more precarious, resting right on their Point of Control (POC) at $236 and their daily 20-EMA. If these support levels fail, the next likely support zone lies all the way down at $230. This level aligns with the rising 50-EMA and represents the next area of high-volume support below the current price. Between $236 and $230, there’s a low-volume pocket, which increases the risk of a swift drop if selling pressure intensifies.

DAILY FOCUS

The Majority Of Stocks Are Breaking Down

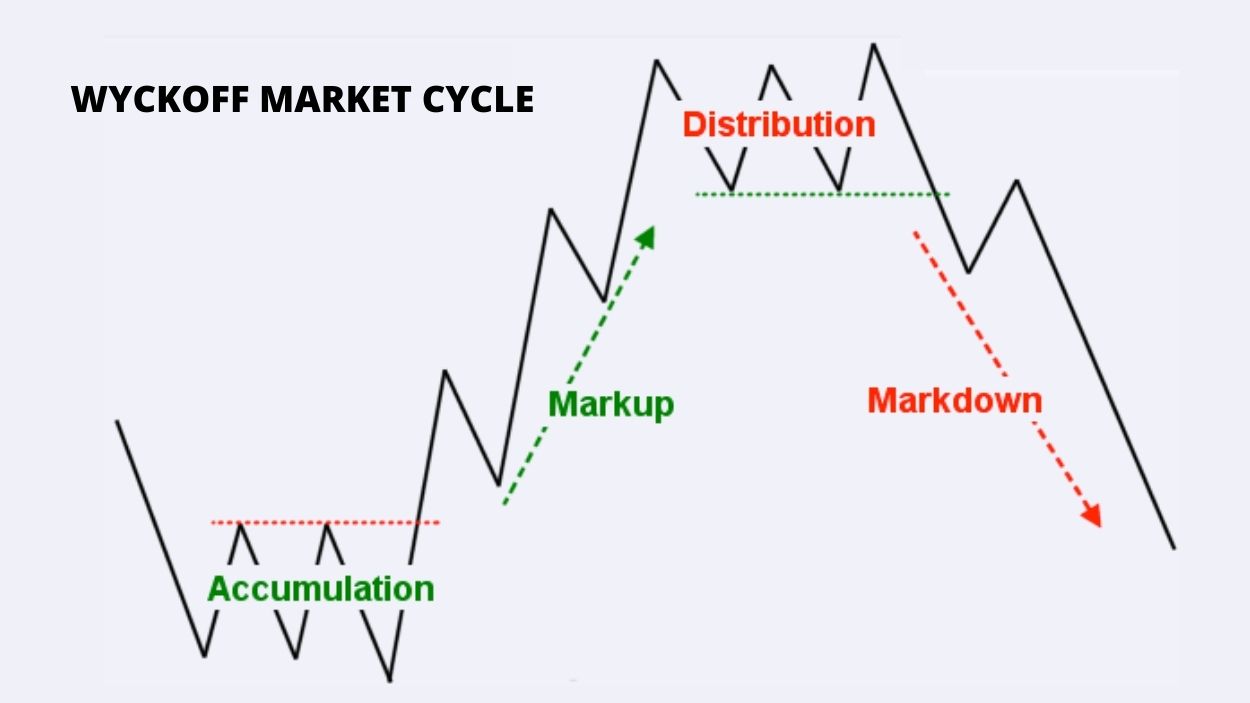

The market appears to be entering a distribution phase, where sellers gradually gain control after a strong bull run. This is a key concept in Wyckoff logic, signaling the potential transition from distribution to a markdown phase. While it’s tempting to assume this could lead to a deep correction, it’s important to keep perspective—this may very well be a short-term pullback. Seasonal trends are still on our side, as December often sees markets rally into the new year.

Remember, not all pullbacks lead to corrections, but every correction begins with a pullback. This is a time to be cautious and risk-off, focusing on preserving your capital. There’s no need to force trades in a choppy environment. Instead, use this time strategically to scan for relative strength in the market.

Ask yourself:

Which stocks are holding their daily 10-EMA and 20-EMA the best?

Which sectors are showing the most resilience?

Are there any pockets of strength that could lead the next move higher when the market stabilizes?

This is a time for patience and preparation. By identifying the strongest stocks and sectors now, you’ll be ready to act when the market regains momentum. Stay disciplined and let the market come to you

WATCHLIST

The Current Relative Strength Leaders

TSLA: Tesla, Inc.

TSLA Daily Chart

Tesla (TSLA) stands out as one of the top performers in our portfolio, with a profitable and protected position currently in play. Since breaking out last week, TSLA has climbed steadily and made multiple attempts to challenge its all-time high of $414.50. Its strong relative strength is particularly notable, as it has resisted the broader breakdown affecting most tech stocks.

That said, we’re not ignoring the likelihood of a pullback, especially given the market’s current environment. However, this is where disciplined trade management comes into play. We’ve already closed 1/3 of the position into strength and moved the stop-loss to breakeven, allowing the remaining shares to ride.

This is a great example of how to handle open positions during a pullback. Don’t rush to sell strong performers just because the general market is weak. Instead, let the stock’s own performance dictate your actions. As swing traders, the goal is simple: let your winners run and cut your losers early.

GOOG: Alphabet Inc (Google)

GOOG Daily Chart

Google (GOOG) has been a strong relative strength leader, but yesterday it experienced a surprising breakdown from a major multi-week base, accompanied by very high relative volume. Despite the breakdown, we decided to pass on this trade due to the overall weakness in the tech sector.

However, GOOG is a stock worth keeping on your radar. Stocks like this, which show resilience during broader market deterioration, can often provide opportunities after a pullback. When these leaders set up secondary flags after a significant move, they’re the names that tend to lead the market out of a correction. Keep an eye on how GOOG behaves in the coming weeks, as it could be one of the stocks to outperform once the market stabilizes.

Did you find value in today's publication?This helps us better design our content for our readers |

This newsletter does not provide financial advice. It is intended solely for educational purposes and does not constitute investment advice or a recommendation to trade assets or make financial decisions. Please exercise caution and conduct your own research.

Reply